Empowering Young Investors: A Vanguard Financial Literacy Case Study

Role

Lead UX Designer

Duration

6 Months

Tools

Figma, FigJam

Introduction - Meet the User

Meet Priya, a 24-year-old recent college graduate eager to start investing. However, she finds financial apps overwhelming due to jargon and lacks confidence in managing her finances.

Challenge – Bridging the Financial Literacy Gap

Many young adults lack financial literacy, costing them an average of $1,819 per year in financial mistakes. Traditional finance apps display spending data but don’t provide structured learning experiences.

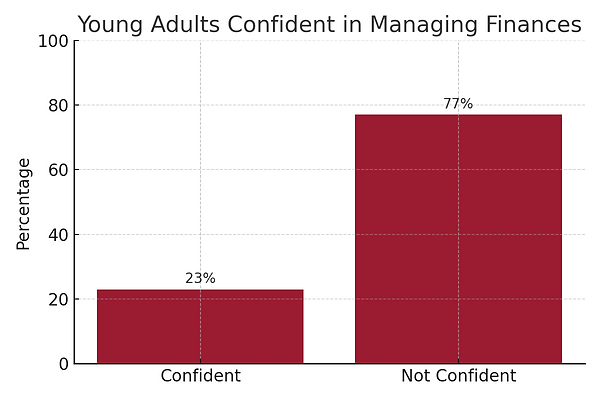

Key Stats:

• Only 23% of young adults feel confident managing their finances.

• Financial literacy among Gen Z is critically low, leading to poor savings habits.

Solution – Integrating Education into the Vanguard App

To bridge this gap, we designed the Financial Literacy Hub within the Vanguard app, offering:

• Interactive Learning Modules – Gamified lessons on budgeting, credit, savings, and investing.

• Personalized Financial Dashboard – Tracks users' financial growth and provides actionable insights.

• Investment Simulator – Allows users to practice investment strategies without real-world risk.

• Community Support – Users engage with financial coaches and peer discussions.

Research & insights

To ensure the solution aligned with real user needs, I conducted both surveys and interviews with six young adults, ages 19–26, from diverse backgrounds. This mixed-method approach allowed me to collect both quantitative data and qualitative insights around financial behavior, app usage, and learning preferences.

User Research

Who I Spoke To:

• 6 participants (3 female, 3 male), of various ethnicities and races

• Ages 19–26 — all recent college students or early-career professionals

• Varying degrees of financial experience, but most were just beginning their financial journeys

Key Survey + Interview Takeaways:

Confidence is Low: Most participants described themselves as not very confident managing money, with investing, retirement planning, and taxes being the top areas of confusion.

Apps Feel Intimidating: Those who tried using apps like Robinhood or Mint often gave up due to complex navigation or financial jargon. Several mentioned feeling like the tools assumed they already knew what they were doing.

Learning Preferences Are Clear: Participants gravitated toward formats like short videos, step-by-step guides, and practice tools. A few expressed interest in human support, like a coach or community.

Strong Interest in Financial Education: 5 out of 6 said they would be very likely to use a feature that helped them learn how to invest while tracking their progress.

Competitive Analysis

To understand where existing tools fall short, I conducted a SWOT-style review of three popular financial apps used by young adults:

Key Insight

While the market offers functional tools for budgeting and investing, there’s a major gap in apps that combine financial education, guidance, and hands-on practice. Young users don’t just want to be told what to do—they want to understand why and how.

User Journey – From Confusion to Confidence

This user journey map showcases Priya’s transformation from a hesitant beginner to a confident investor. By following her goals, actions, and emotions at each phase, we uncover opportunities to enhance support, provide personalized insights, and empower users to take control of their financial future.

Design Process – Wireframing & Refining

Through user research and testing, we iterated designs to refine usability. Key findings:

• Users wanted clearer navigation between learning modules and investment tools.

• Adding a clear call-to-action significantly increased engagement with the Investment Simulator.

• User feedback led to a more intuitive layout for the Financial Health Dashboard.

Impact and Business Value

This feature benefits both young investors and Vanguard:

• Empowers Users – Improves financial literacy and investment readiness.

• Increases Engagement – Users return frequently to track progress

• Boosts Conversions – Users invest earlier, increasing Vanguard’s client base.

• Strengthens Brand Leadership – Positions Vanguard as a trusted financial education provider.

Conclusion & Future Opportunities

By integrating financial education within the Vanguard ecosystem, this solution enhances user engagement, improves financial literacy, and encourages smart investment decisions. Future opportunities include:

-

AI-Driven Financial Coaching: Provide users with actionable insights through personalized AI recommendations, simulating a financial advisor experience

-

University Partnerships: Collaborate with universities to offer in-app financial literacy programs as part of career preparation workshops.

-

Personalized Investment Strategies: Implement a feature that dynamically adjusts recommendations based on a user’s financial goals, behavior, and market conditions.

Reflection

This project highlighted the importance of integrating financial education into user experiences. Through user research and testing, it became clear that users value personalized guidance and actionable insights. Moving forward, a greater emphasis on AI-powered financial coaching and educational partnerships could further drive engagement and financial confidence among young investors.